Cayman Islands Stamp Duty

Welcome to our guide on Stamp Duty as it relates to real estate transactions in the Cayman Islands. Whether you're buying, selling, or investing in property, comprehending Stamp Duty is vital. This tax plays a significant role in real estate transactions across the islands. Here, we provide detailed insights into Stamp Duty in the context of Cayman Islands real estate.

What Is Property Stamp Duty?

Property Transfer Duty is a form of Stamp Duty specifically applied to the transfer or sale of real estate in the Cayman Islands. It is a mandatory tax collected by the Cayman Islands Government, contributing to the financing of public services and infrastructure development.

Responsibility for Paying Property Transfer Duty

In most real estate transactions, the responsibility for paying Property Transfer Duty falls on the buyer. However, it is essential to clarify this aspect during negotiations and property purchase agreements.

Exemptions and Discounts

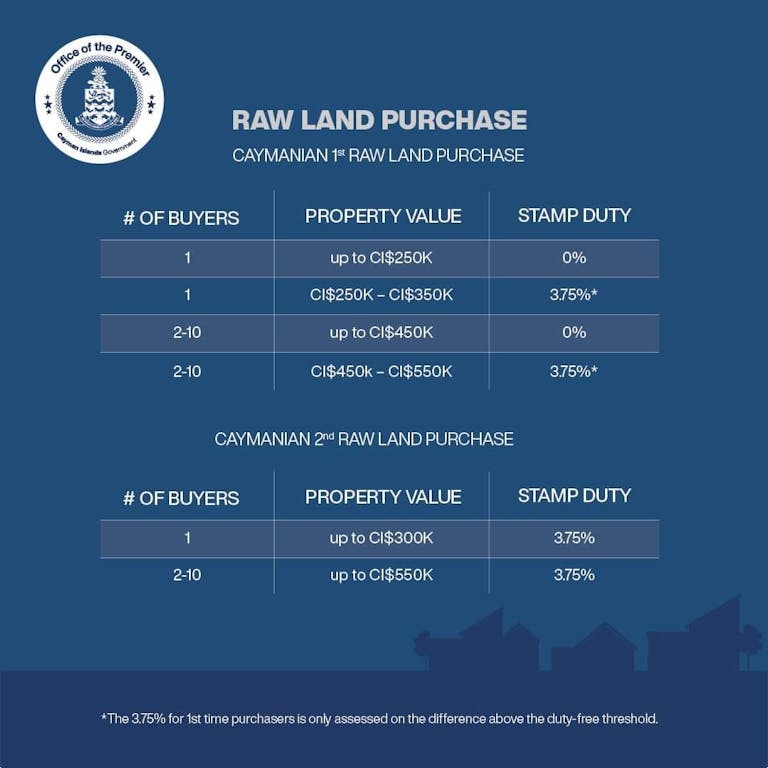

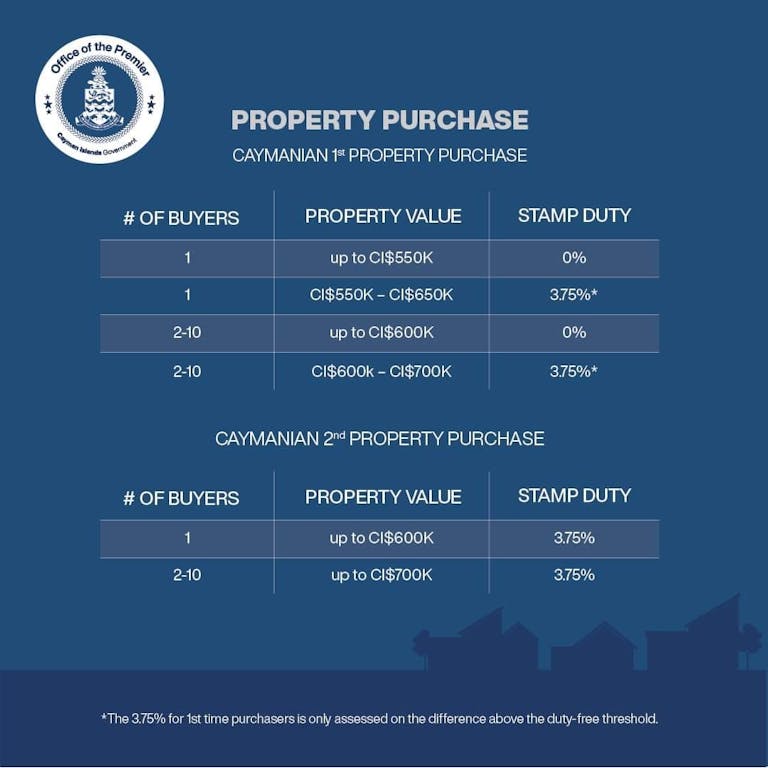

There are circumstances where you could qualify for a duty reduction, or just pay a filing fee, if you are transferring to your own children, inheriting, or are a first- or second-time Caymanian Buyer (see chart below). Stamp Duty laws and various incentives are something we at Property Pals can help you understand fully as part of the purchasing process.

Compliance and Filing

To ensure compliance with Property Transfer Duty regulations, it is crucial to accurately complete the necessary forms and submit them to the Cayman Islands Department of Lands and Survey. Non-compliance can result in penalties or legal complications.

Professional Guidance

Navigating the complexities of Property Transfer Duty in real estate transactions is best done with professional guidance. Real estate agents, attorneys, and tax professionals can provide invaluable assistance to ensure accurate calculations, compliance, and a smooth transaction.

Property Transfer Duty is a significant aspect of real estate transactions in the Cayman Islands. Understanding its implications, rates, exemptions, and compliance requirements is essential for both buyers and sellers. For specific details and the most up-to-date information, it is advisable to consult official government sources or seek guidance from legal and financial professionals specializing in real estate matters.

Please be aware that Property Transfer Duty regulations and rates may change over time, and it is essential to stay informed about any updates from the Cayman Islands Government.

Everyone has to pay Stamp Duty of some kind, and it is generally 7.5% of the value of the real property island-wide.